By U.S. Senate Majority Leader Mitch McConnell

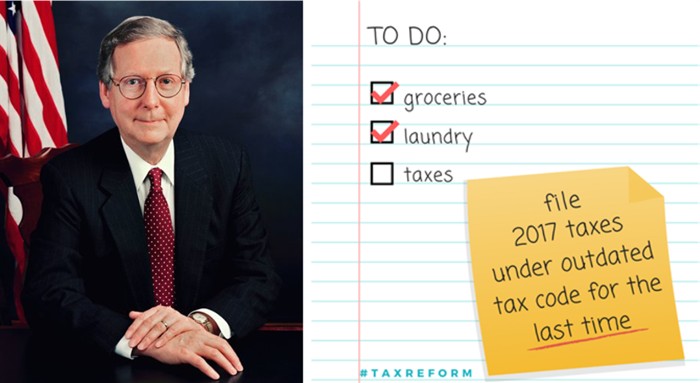

This time of year, Americans are taking part in an annual headache-inducing ritual: filing their income tax returns. Most of us dread completing this complicated paperwork and writing a check to the IRS each year, particularly under the current arcane federal tax system. Thankfully, as a result of the historic overhaul of the federal tax code, this is the last time that you will have to file under the outdated and expensive system that has held our country back for far too long.

Working with President Trump, the Republican-led Congress passed a once-in-a-generation law to take money out of Washington’s pocket and put it back into the pockets of Kentuckians like you. You earned the money in the first place. Now you can keep more of it.

At its core, our tax plan was written to help families get ahead and small businesses thrive. That’s why we doubled the standard deduction, meaning less of your income will be subjected to taxation. The new law also substantially expands the child tax credit, protects the adoption tax credit, and includes a number of other pro-family provisions, such as paid family leave incentives. When filing their taxes next year, an average family of four earning the median income of around $70,000 could see a tax cut more than $2,000.

While some Washington liberals deride our tax reform law as “Armageddon,” many families throughout the country are already seeing that this ridiculous rhetoric bears no relationship to reality. Unemployment is decreasing and consumer confidence is rising. Kentucky families and workers are seeing an economy that is finally getting back on track.

Although individuals are still filing under the old system this year, you won’t have to wait until next year to start enjoying many of the new tax law’s benefits. With the IRS withholding less money from each paycheck, Kentuckians are already seeing more money in their take-home pay. That makes an immediate impact on family budgets.

In addition, hundreds of employers and counting are sharing their tax savings with their employees through larger paychecks, employee bonuses, and increased benefits like paid leave. Walmart is raising its minimum wage and paying cash bonuses to more than 18,000 associates in our state. Kentucky-based employers like Humana and Brown-Forman have chosen to increase pay incentives, reinvest in the community, or contribute to pension programs. U.S. Bank and Fifth Third Bank are also crediting tax reform with new rounds of raises and bonuses.

And these are just a few examples.

These incredible tax reform benefits extend from the largest private employer in Louisville, UPS, to many of Kentucky’s smallest businesses – like CSS Distribution Group, which has 13 employees. CSS is utilizing the benefits of tax reform to hire new employees and has told current employees that “due to the new tax law … we expect bonuses to be much larger this year than in the past.” It seems like nearly every day since President Trump signed the bill into law, we hear more announcements about benefits for hard-working Americans. Nancy Pelosi may call these bonuses “crumbs,” but that is real money that Kentuckians can use to pay the bills, save for their child’s education, or take their family on vacation. Our own State Treasurer has called it “a clear win for Kentucky families.”

And Kentuckians get to see the results of tax reform in other ways as well. Recently, utility companies from around the Commonwealth have announced that they are reducing their rates because of – you guessed it – the new federal tax reform law. Louisville Gas and Electric, Kentucky Utilities, and Kentucky Power are all passing their new savings along to their customers. Lower utility bills are just another way that Kentuckians will get to keep more of their hard-earned money.

The results are clear: the new tax law is working in Kentucky. Families and workers have more money in their pockets and small businesses have the chance to grow and succeed.

Thankfully, this is the last time you will have to use the outdated individual tax system. Many hard-working Kentuckians will continue to enjoy the full benefits of tax reform as its impacts grow.

###

Mitch McConnell, a Republican, is Kentucky’s senior Senator and the United States Senate Majority Leader.